What is the Consumer Data Right (CDR)?

The Australian Government has developed a series of data standards that help you to access information about your financial products. These standards form part of the Consumer Data Right designed to allow consumers greater control over their data.

CDR provides Australian consumers with more control over how their data is used and disclosed and their privacy. It will improve consumers’ ability to compare and switch between products and services, encourage competition between service providers, drive the development of more innovative products and services, and reduce prices. You can read more about these changes at Consumer Data Standards Australia.

Open Banking is the first sector of the Consumer Data Right (CDR). Open Banking will give you the ability to consent to sharing your banking data with trusted third parties that have been accredited by the Australian Competition and Consumer Commission (ACCC). Under the Open Banking framework, you will be able to control which third party can access your data.

What do I need to know about Open Banking and the Consumer Data Right (CDR)?

-

Open Banking will make data on banking products more accessible and comparable, allowing you to easily see if you are using the best product for your needs.

-

Any party that you consent to receiving your data has to be accredited by the Australian Competition and Consumer Commission (ACCC) to be able to access data. To find out who is accredited by the ACCC to receive data through open banking, visit ACCC website.

-

Additional safeguards have been developed to enhance and ensure your privacy in the use of Open Banking. More information about these are available on the Office of the Australian Information Commissioner website.

-

RSL Money does not charge our members for the CDR service.

Consumer Data Right Policy

As a data holder we share your banking data with accredited third parties if you authorise us to. We do this in accordance with our Consumer Data Right Policy.

To be eligible for data sharing, you:

-

Must be at least 18 years old and registered for Internet banking

-

Must have an eligible personal account

Types of data we may share with your permission

-

Name and contact details

-

Transaction details

-

Account balance

-

Direct debits and scheduled payments

-

Saved payees

-

Product information

How to share your data

Provide your consent on the website or app of the accredited recipient you want to share your RSL Money data with first. You will then be taken securely to RSL Money so you can set up sharing in few steps.

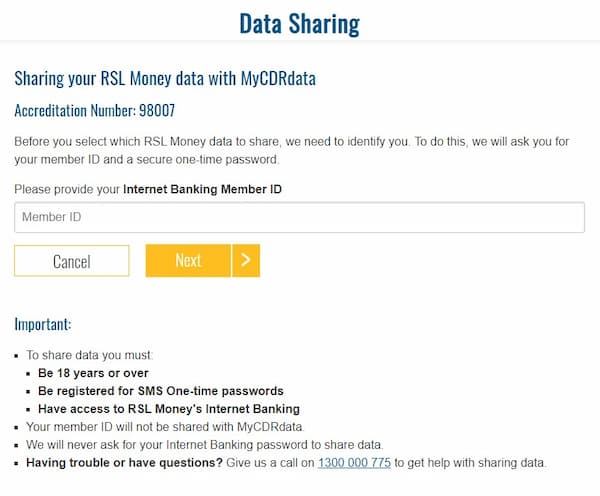

Step 1

Enter your Member ID and we will send one time password to your registered mobile number.

Step 2

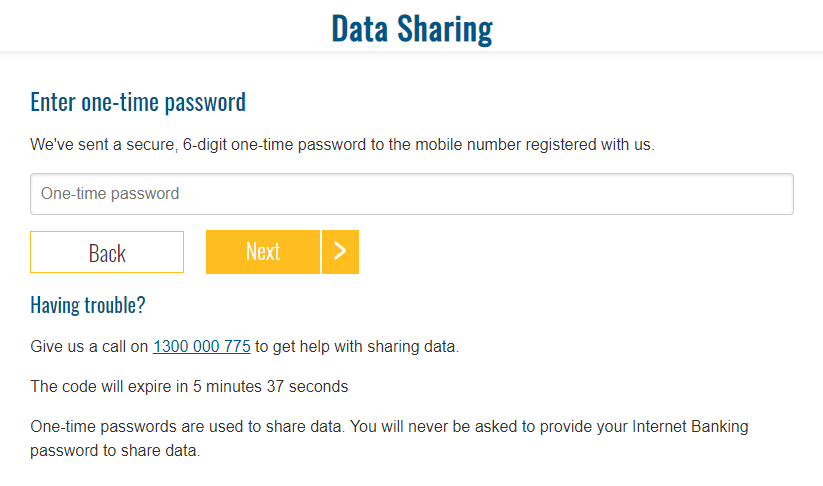

Check the SMS sent to your registered mobile number and enter 6-digit one-time password.

Step 3

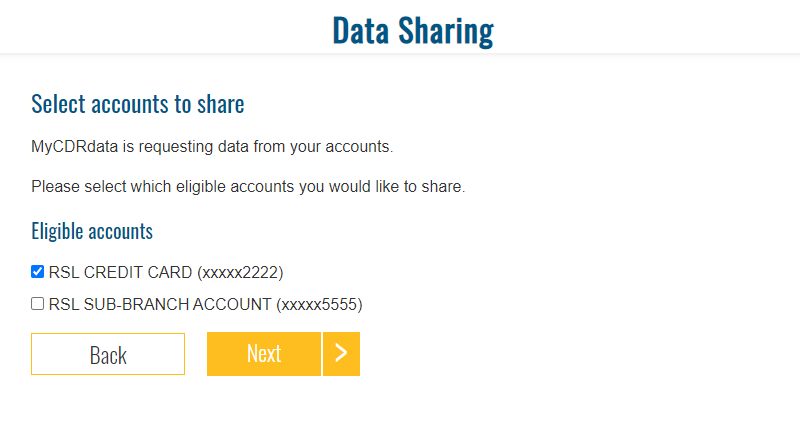

Choose which accounts you would like to share the data from.

Step 4

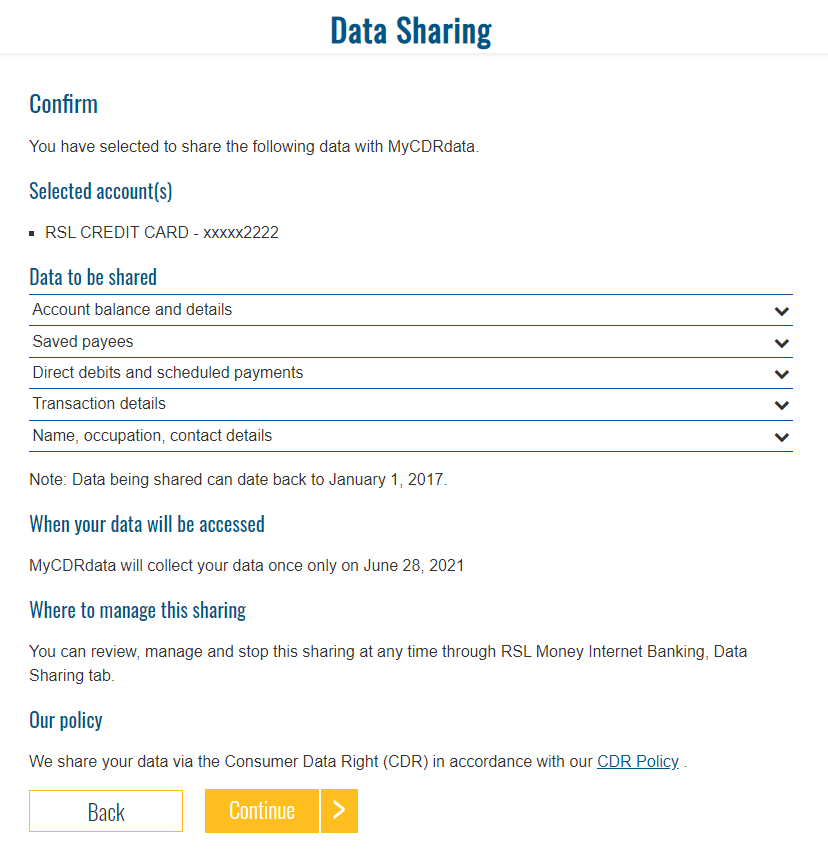

Review the details and confirm you want to share the data. We will then take you securely back to the accredited organisation you started on.

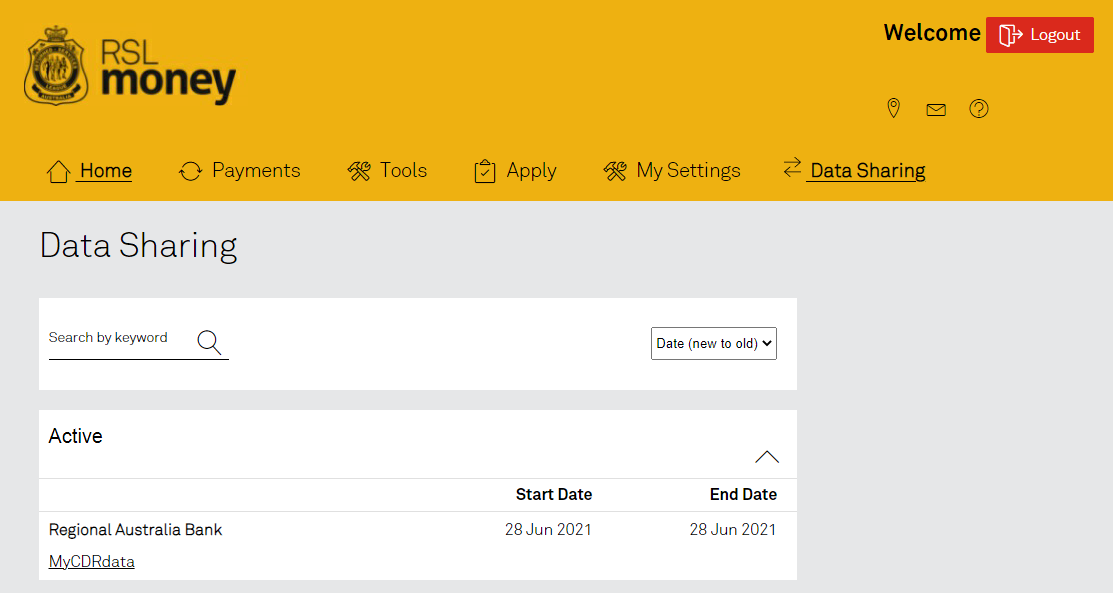

View or manage sharing

To view or manage your data sharing at any time Login to your RSL Money Internet Banking and click on Data Sharing. You will see all your active and expired data sharing requests listed here.

Click on the accredited Organisation name to view details of your consent and CDR data being shared. To stop sharing at any time click on the stop sharing button and confirm. This will cancel your consent of Australian Military Bank data being shared with the third party.

Sharing data from a joint account

A joint account is enabled for data sharing unless an account holder chooses to disable it. When enabled for data sharing, any account holder can share data from this account with accredited data recipients without further approval. Any account holder is also able to choose to stop sharing data from the joint account any time. If the account is disabled and you want to enable it for data sharing, all account holders must agree and approve the request. To enable or disable a joint account for sharing, log on to Online Banking and go to Data Sharing tab, and then Account Permissions.

Privacy

To learn more about how we manage your data and the security standards relating to the CDR read:

Consumer Data Right Policy

Our Privacy Policy

Complaints

If you are unhappy with the way that we have dealt with your CDR Data, you can access our internal dispute resolution scheme at any time without charge. You can make a CDR complaint in the following ways:

Help

If you need help at any time or have a question about the CDR and Open Banking, you can contact us via email service@rslmoney.com.au or call us on 1300 13 23 28 Monday - Friday: 8:00am – 6:00pm Saturday: 9.00am - 12.00pm AEST.

For Developers

We offer unrestricted APIs for developers to access our product information.

APIs include:

-

Products

-

Features

-

Eligibility criteria

-

Fees

-

Interest rates

For the below products:

-

Transaction Accounts

-

Savings Accounts

-

Term Deposits

-

Credit Cards

-

Residential Mortgages

-

Personal Loans

|

Type |

URL |

|

Product API |

https://public.open.rslmoney.com.au/cds-au/v1/banking/products |

|

Product Detail API |

https://public.open.rslmoney.com.au/cds-au/v1/banking/products/{productId} |